So just got told to re do W4 in the 2020 form.

Anyone figure this shit out?

Instead of deductions they want a dollar amount of how much to take out which I have no idea because of my overtime is dependent on if it’s a busy season.

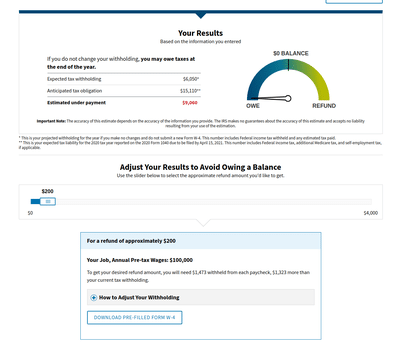

And the IRS calculator tells me how much I will get taxed (from a rough estimate), but not what to put down on the W4 to achieve that.

Help please.

**This thread was edited on May 13th 2020 at 1:40:00pm

A quick word on blocking ads

It looks like you are using an ad blocker. That's okay. Who doesn't? But without advertising revenue, we can't keep making this site awesome. Click the link below for instructions on disabling adblock.