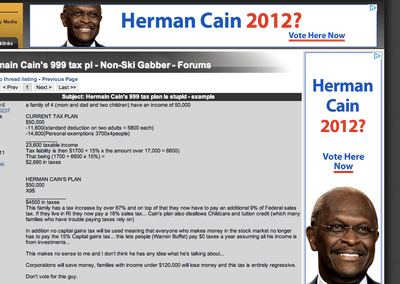

a family of 4 (mom and dad and two children) have an income of 50,000

CURRENT TAX PLAN

$50,000

-11,600(standard deduction on two adults = 5800 each)

-14,600(Personal exemptions 3700x4people)

___________

23,600 taxable income

Tax liability is then $1700 + 15% x the amount over 17,000 = 6600)

That being (1700 + 6600 x 15%) =

$2,690 in taxes

HERMAN CAIN'S PLAN

$50,000

X9$

______________

$4500 in taxes

This family has a tax increase by over 67% and on top of that they now have to pay an additional 9% of Federal sales tax. If they live in RI they now pay a 16% sales tax... Cain's plan also disallows Childcare and tuition credit (which many families who have trouble paying taxes rely on)

In addition no capital gains tax will be used meaning that everyone who makes money in the stock market no longer has to pay the 15% Capital gains tax... this lets people (Warren Buffet) pay $0 taxes a year assuming all his income is from investments...

This makes no sense to me and I don't think he has any idea what he's talking about...

Corporations will save money, families with income under $120,000 will lose money and this tax is entirely regressive.

Don't vote for this guy.

A quick word on blocking ads

It looks like you are using an ad blocker. That's okay. Who doesn't? But without advertising revenue, we can't keep making this site awesome. Click the link below for instructions on disabling adblock.